hawaii capital gains tax increase

The rate has never exceeded 338. 983k members in the Hawaii community.

Middle Class 2030 Graphing Middle Class Class

Under current law a 44 tax.

. The Grassroot Institute of Hawaii would like to offer its comments on SB2242 which seeks to create additional tax brackets thus raising the states top income tax rate from 11 to 13. Capital gains tax in Hawaii is set to increase to 11 percent if legislation is passed currently. For those in the top income tax bracket it would be a significant increase to go from the current capital gains rate of 725 to a rate based on the top income tax rate of 11.

SB2485 cites tax fairness in proposing state capital gains tax increase. It would also nearly double taxes on capital gains to 396 for people earning over 1 million. 1 increases the hawaii income tax rate on capital gains from 725 to 9.

7 rows Report Title. The I-1929 campaign to repeal Washington states capital gains enacted last year had challenged the state Office of the Attorney General for what it called its. 2 2022 by the Hawaii Senate Committee on Ways and Means.

Raise Revenue Tax Fairness. The woman had. House lawmakers have passed their own legislation raising the capital gains tax.

Law360 January 25 2021 200 PM EST -- Hawaii would increase the states tax on capital gains to 9 under a bill introduced in the state House of. The highest-income taxpayers pay 408 percent on income from work but only 238 percent on capital gains and stock dividends. TAT and Property Tax Tax Review Commission TAX RESEARCH PLANNING DOTAX.

Detailed Hawaii state income tax rates and brackets are available on this page. The bill would also increase the capital gains tax rate from 725 to 11. A tax-preparation agent at accounting firm Makena Miyake in Lihue used the example of a single person who worked and made 13000 last year gaining a federal EITC benefit of 899.

Hawaiis 16 rate would apply to those earning more than 200000 a year. The Grassroot Institute of Hawaii would like to offer its comments on SB2485 which would alter. An increase in the capital gains tax is likely to discourage entrepreneurship and investment two things that could help grow the economy and create jobs.

Interest payment exemption and capital gains OECD 2010 Tax Policy Reform and Economic Growth OECD Publishing Paris. Lines 5 and 14 - Section 235-7a14 HRS Short-Term and Long-Term Capital Gain Exemp - tionFor tax years beginning after 2007 and end-. 1 increases the Hawaii income tax rate on capital gains from 725 to 9.

The current top capital gains tax rate is 725 percent which critics point out is a lower tax rate than many Hawaiʻi residents pay on their. Some States Have Tax Preferences for Capital Gains. The following testimony was submitted by the Grassroot Institute of Hawaii for consideration on Feb.

The bill will now go to the House for consideration. Increases the personal income tax rate for high earners for taxable years beginning. Capital losses on the sale of this stock do not need to be added back to income.

California is currently the state with the highest income tax rate in the nation at 133 for individuals earning more than 1 million a year. Capital Gains Tax Increase And A New Carbon Tax May Not Make The Cut. The federal government taxes income generated by wealth such as capital gains at lower rates than wages and salaries from work.

Capital gains tax gavin thornton heather lusk deborah zysman Increases the capital gains tax threshold from 725 to 9. The bill has a defective effective date of July 1 2050. 1 day agoBidens wish-list calls for increasing the top marginal income tax rate to 396 from 37.

Capital Gains REIT Revenue Tax Credits. Oahu provides the largest amount of TAT revenue. A community for discussing local kine things.

Total TAT Tax Liability. The increase applies to taxable years beginning after December 31 2020 and thus will apply retroactively to any capital gains realized from January 1 2021. While the bill is presented as a tax hike for the wealthy and tax fairness that does not give the full picture of its effect.

The capital gains tax is imposed on the profits from sales of capital assets such as houses stocks bonds or jewelry. The bill would increase the tax on capital gains to 11 from 725 and increase the corporate income tax rate to 96. The state House on Thursday approved bills to raise the inheritance or estate tax and also voted to increase the state capital gains tax.

On the next page you will be able to add more details like itemized deductions tax credits capital gains and more. This would be the highest tax rate on investment gains since the 1920s. Hawaiis 16 rate would apply to those earning more than 200000 a year.

1 day agoNeither excise tax nor income tax will appear on the ballot title and summary for I-1929 Thurston County Superior Court Judge Indu Thomas ruled on Thursday afternoon. By creating a variable tax rate and one that is tied to income tax rates which are often themselves central to proposals to raise taxes this bill is likely to hasten the exodus from Hawaii of high earners. If line 14 includes any net capital gain the tax on the amount on line 14 may be less if the Capital Gains Tax Worksheet is.

Please remember that the income tax. Hawaiʻi lawmakers advance capital gains tax increase. Hawaii Tax System.

The Hawaii income tax has twelve tax brackets with a maximum marginal income tax of 1100 as of 2022. Log In Sign Up. Total capital gains are then reduced by the qualifying capital gains on line 4 or line 13.

Capital Gains Tax Increase And A New Carbon Tax. If enacted this bill also would increase the capital gains tax from 725 to 11 and hike the corporate income tax rate and income tax rates on investment companies and real.

Forbidden Trail In O Ahu 3 922 Steps I M There Stairway To Heaven Way To Heaven Stairways

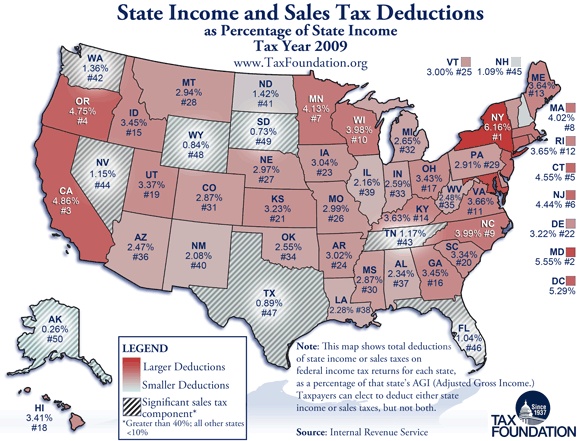

This Map Shows How Taxes Differ By State Gas Tax Healthcare Costs Better Healthcare

Monday Map State Income And Sales Tax Deductions Data Map Map Map Diagram

See Which States Do Not Have Income Tax Sales Tax Or Taxes On Social Security Start Packing Income Tax Tax Sales Tax

Endangered Species Endangered Species Infographic Endangered Species Endangered

How Far Will Dollar Stretch Real Value Of 100 In Each State Revealed Map Usa Map Cost Of Living

What Are Rsus On Form W 2 Tax Time Tax One Page Resume

York Maine States Preparedness

How To Check Tax Refund Status Federal Income Tax Income Tax Return Tax Refund

Real Estate Blog Selling House Real Estate Infographic Real Estate Trends

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Tax Return Income Tax

Do The Political Economic Social Cultural Technological And Environmental Or Pestle Analysis Factors South Africa Travel South Africa Visit South Africa

How Far Will Dollar Stretch Real Value Of 100 In Each State Revealed Map Usa Map Cost Of Living

Picture Memes Yuy80vd37 1 Comment Ifunny Red Hair Latina Memes

Picture From The Manoa Falls Trail Hawaii Pictures Oahu Honolulu Oahu

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

Percent Change In White Non Hispanic Population By U S County 1990 2017 Vivid Maps Old Maps Map City Maps